How Much Does Your Company Lose Due to Accounting Errors?

1st July 2019 | By Jan Cahill

Accounting errors and fraud can have a significant financial impact on your business. Errors are commonplace due  to the manual tasks, volumes of data and people involved in the process and unfortunately procurement fraud is also prevalent, with 31% of UK companies subject to contract bid rigging and 43% to duplicate invoices, according to a report by research and analytics firm SAS.

to the manual tasks, volumes of data and people involved in the process and unfortunately procurement fraud is also prevalent, with 31% of UK companies subject to contract bid rigging and 43% to duplicate invoices, according to a report by research and analytics firm SAS.

How Can These Problems Be Prevented?

Processes such as account statement reconciliation can help, however, this is traditionally a lengthy, manual process and – let’s be honest – can take so much time to manually check and match the ledger against the statement, let alone check additional documentation as well (e.g. purchase orders or invoices). Manual processes are simply inadequate to spot duplicate invoices and other accounting errors when you have a high volume of transactions, as well as different types of data e.g. paper and digital. So it’s time to consider transforming your finance operations using the latest tech.

Emerging technology such as robotic process automation can be utilised to validate, verify and analyse finance data automatically. Performing manual tasks such as automated accounts statement reconciliation to spot duplicate invoices, accounting errors and other issues such as invalid or no purchase order, or even unmatched invoice amounts.

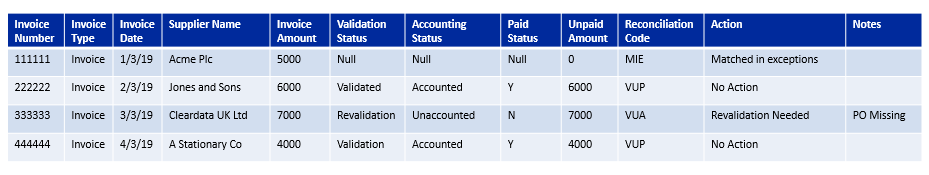

Cleardata offers accounts statement reconciliation via its Robocloud Robotic Process Automation (RPA) services, using a team of cloud based software robots. Don’t worry – our digital workforce won’t take over! They simply work alongside your employees to provide a reconciled spreadsheet of data ready for your next steps. The data is output to any required format, generally csv or excel and will include a list of exceptions, along with agreed reconciliation codes for your team to action. Including details such as invoice number, date, amount and status.

Our Robocloud digital workforce ensure your statement reconciliation is completed frequently and consistently, to help identify accounting errors, duplicate invoices and payments without an authorised purchase order, saving your company both time and money and providing early warning signals for any fraudulent activity.

This automated solution can also help identify outstanding unreconciled transactions on your ledger, which is a common issue when a business may have received a credit note for an invoice, but it hasn’t been resolved. Robocloud has worked with several clients on automated statement reconciliation and has helped to bring clarity and insight to their ledgers which is making their ongoing statement reconciliation process much easier and cost effective.

RPA Services can be used as and when you need them via a simple monthly fee. This is a scalable solution, so if you have peaks and troughs in your volumes our digital workforce can cope, no need for additional training and recruitment costs.

We’re offering a limited number of free discovery sessions, combined with a demo to show you how automated statement reconciliation processes work using your data. Our team will need to discuss and agree your reconciliation rules, along with a data feed of your statement and ledger. Interested? Contact us or call 0800 046 8086.

Watch our automated accounts statement reconciliation video to find out more:-

Automated Statement Reconciliation Benefits

Manual accounts tasks are intrinsically prone to error due to the amount of digits and data involved. From disorganisation to mathematical errors, there are all kinds of factors which lead to issues whilst reconciling data. Below we outline some of the benefits of automating your statement reconciliation process.

Improve Accuracy

Robocloud’s validation/verification robots complete account reconciliation tasks in a consistent, logical manner and can perform two, three or even four way matching. This means that checks are automatically conducted across multiple systems and reduces human error.

Save Money – Reduce duplicate invoices and payments

With our robots on your team, duplicate invoices or payments will be identified quickly and easily, saving your business potentially thousands in mispayments. We’ve already saved thousands for our customers using this automated service.

Identify fraudulent transactions

Early warning and monitoring to help identify fraudulent transactions based on your business rules.

Speed up statement reconciliation processes

Our robots work around the clock to perform statement reconciliation. They don’t get bored or distracted and will perform the task in line with your rules/requirements. This means your reconciliation will be completed without fail as and when scheduled.

Free up employee time

Without having to dedicate their time to accounts reconciliation, your employees will have more time to perform more complex tasks. This will help to support business growth as well as improving employee satisfaction.

For further details about Cleardata’s Automated Accounts Statement Reconciliation Services call our team on 0800 046 8086 or contact us.